Credit cards offer convenience and rewards, but they can also lead to financial challenges if not managed responsibly. A significant portion of the adult population in the United States carries credit card debt, impacting their financial well-being and future prospects. Understanding the prevalence and factors contributing to this debt is crucial for both individuals and policymakers. This article delves into the statistics surrounding credit card debt among adults, exploring the contributing factors and potential solutions for navigating this common financial hurdle.

Prevalence of Credit Card Debt: Key Statistics

Several studies and reports provide insights into the extent of credit card debt among American adults. The numbers vary slightly depending on the source and methodology, but they consistently point to a widespread issue. Let’s examine some key findings:

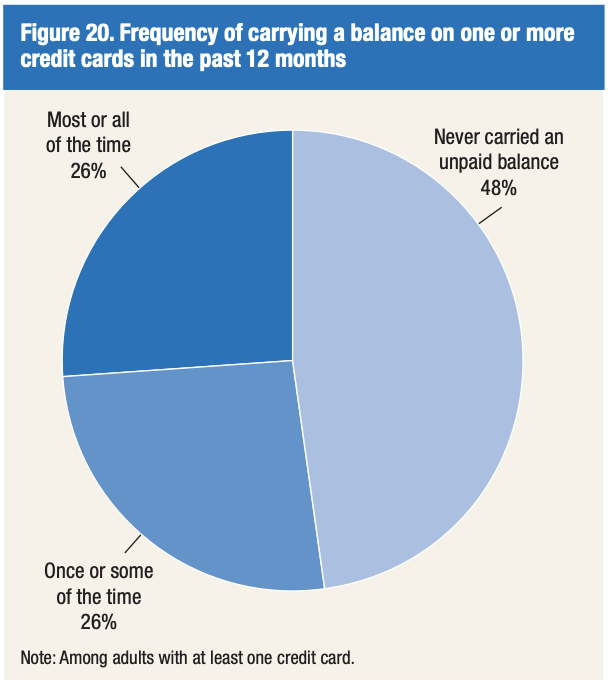

- According to recent surveys, approximately 40-50% of US adults carry a balance on their credit cards each month.

- The average credit card debt per person with debt is estimated to be in the range of $5,000 to $6,000.

- Millennials and Gen Z tend to have lower average credit card debt compared to older generations, but they are also more likely to struggle with repayment.

Factors Contributing to Credit Card Debt

Several factors contribute to the prevalence of credit card debt among adults. Understanding these factors is important for developing strategies to prevent and manage debt effectively.

- Unexpected Expenses: Medical bills, car repairs, and home emergencies can force individuals to rely on credit cards.

- Low Financial Literacy: A lack of understanding about interest rates, fees, and debt management can lead to overspending and accumulation of debt.

- Job Loss or Reduced Income: Unemployment or underemployment can make it difficult to meet financial obligations and rely on credit cards to bridge the gap.

- Overspending and Lifestyle Creep: Increasing expenses as income rises can lead to overreliance on credit and difficulty saving.

Demographic Trends in Credit Card Usage and Debt

Credit card usage and debt levels can vary across different demographic groups. Understanding these variations can help tailor financial education and support programs.

| Demographic Group | Typical Credit Card Usage | Average Debt Level | Key Considerations |

|---|---|---|---|

| Millennials (born 1981-1996) | High usage for convenience and rewards | Lower than older generations but increasing | Student loan debt often impacts ability to repay |

| Gen X (born 1965-1980) | Established credit history, moderate usage | Higher debt levels, often balancing family expenses | May be juggling multiple financial responsibilities |

| Baby Boomers (born 1946-1964) | Varied usage, some prefer cash | High debt levels, potentially due to retirement planning | May be facing medical expenses or supporting family members |

Strategies for Managing and Reducing Credit Card Debt

While the prevalence of credit card debt can seem daunting, there are effective strategies for managing and reducing debt. These strategies require discipline and commitment, but they can lead to significant improvements in financial well-being.

- Budgeting and Tracking Expenses: Creating a budget and tracking spending can help identify areas where expenses can be reduced.

- Debt Consolidation: Transferring high-interest debt to a lower-interest loan or credit card can save money on interest payments.

- Balance Transfers: Transferring balances to credit cards with 0% introductory APRs can provide a temporary reprieve from interest charges.

- Debt Snowball or Avalanche Method: Prioritizing debt repayment based on either balance or interest rate can help accelerate debt reduction.

- Seeking Professional Help: Credit counseling agencies can provide guidance and support in developing debt management plans.

FAQ: Common Questions About Credit Card Debt Q: What is a good credit utilization ratio?

A: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit on each card.

Q: How does credit card debt affect my credit score?

A: High credit card balances and missed payments can negatively impact your credit score, making it harder to get loans or secure favorable interest rates.

Q: What are the consequences of not paying my credit card bill?

A: Late payments can result in late fees, increased interest rates, and damage to your credit score. Continued non-payment can lead to debt collection and legal action.

Q: Is it ever okay to use a credit card to pay for necessities?

A: While sometimes unavoidable, relying on credit cards for necessities should be a temporary measure. It’s crucial to create a budget and explore other options to avoid accumulating debt.

Credit card debt is a common but manageable challenge facing many adults. Understanding the statistics, contributing factors, and effective strategies for debt reduction is crucial for achieving financial stability. By practicing responsible spending habits, prioritizing debt repayment, and seeking professional help when needed, individuals can take control of their finances and build a brighter financial future. It’s vital to remember that consistent effort and a proactive approach are key to overcoming credit card debt and achieving long-term financial well-being. Taking the first step towards managing your debt can significantly reduce stress and pave the way for a more secure financial future. Start small, stay consistent, and celebrate your progress along the way.

Credit cards offer convenience and rewards, but they can also lead to financial challenges if not managed responsibly. A significant portion of the adult population in the United States carries credit card debt, impacting their financial well-being and future prospects. Understanding the prevalence and factors contributing to this debt is crucial for both individuals and policymakers. This article delves into the statistics surrounding credit card debt among adults, exploring the contributing factors and potential solutions for navigating this common financial hurdle.

Several studies and reports provide insights into the extent of credit card debt among American adults. The numbers vary slightly depending on the source and methodology, but they consistently point to a widespread issue. Let’s examine some key findings:

- According to recent surveys, approximately 40-50% of US adults carry a balance on their credit cards each month.

- The average credit card debt per person with debt is estimated to be in the range of $5,000 to $6,000.

- Millennials and Gen Z tend to have lower average credit card debt compared to older generations, but they are also more likely to struggle with repayment.

Several factors contribute to the prevalence of credit card debt among adults. Understanding these factors is important for developing strategies to prevent and manage debt effectively.

- Unexpected Expenses: Medical bills, car repairs, and home emergencies can force individuals to rely on credit cards.

- Low Financial Literacy: A lack of understanding about interest rates, fees, and debt management can lead to overspending and accumulation of debt.

- Job Loss or Reduced Income: Unemployment or underemployment can make it difficult to meet financial obligations and rely on credit cards to bridge the gap.

- Overspending and Lifestyle Creep: Increasing expenses as income rises can lead to overreliance on credit and difficulty saving.

Credit card usage and debt levels can vary across different demographic groups. Understanding these variations can help tailor financial education and support programs.

| Demographic Group | Typical Credit Card Usage | Average Debt Level | Key Considerations |

|---|---|---|---|

| Millennials (born 1981-1996) | High usage for convenience and rewards | Lower than older generations but increasing | Student loan debt often impacts ability to repay |

| Gen X (born 1965-1980) | Established credit history, moderate usage | Higher debt levels, often balancing family expenses | May be juggling multiple financial responsibilities |

| Baby Boomers (born 1946-1964) | Varied usage, some prefer cash | High debt levels, potentially due to retirement planning | May be facing medical expenses or supporting family members |

While the prevalence of credit card debt can seem daunting, there are effective strategies for managing and reducing debt. These strategies require discipline and commitment, but they can lead to significant improvements in financial well-being.

- Budgeting and Tracking Expenses: Creating a budget and tracking spending can help identify areas where expenses can be reduced.

- Debt Consolidation: Transferring high-interest debt to a lower-interest loan or credit card can save money on interest payments.

- Balance Transfers: Transferring balances to credit cards with 0% introductory APRs can provide a temporary reprieve from interest charges.

- Debt Snowball or Avalanche Method: Prioritizing debt repayment based on either balance or interest rate can help accelerate debt reduction.

- Seeking Professional Help: Credit counseling agencies can provide guidance and support in developing debt management plans.

A: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit limit on each card.

A: High credit card balances and missed payments can negatively impact your credit score, making it harder to get loans or secure favorable interest rates.

A: Late payments can result in late fees, increased interest rates, and damage to your credit score. Continued non-payment can lead to debt collection and legal action.

A: While sometimes unavoidable, relying on credit cards for necessities should be a temporary measure. It’s crucial to create a budget and explore other options to avoid accumulating debt.

Credit card debt is a common but manageable challenge facing many adults. Understanding the statistics, contributing factors, and effective strategies for debt reduction is crucial for achieving financial stability. By practicing responsible spending habits, prioritizing debt repayment, and seeking professional help when needed, individuals can take control of their finances and build a brighter financial future. It’s vital to remember that consistent effort and a proactive approach are key to overcoming credit card debt and achieving long-term financial well-being. Taking the first step towards managing your debt can significantly reduce stress and pave the way for a more secure financial future. Start small, stay consistent, and celebrate your progress along the way.