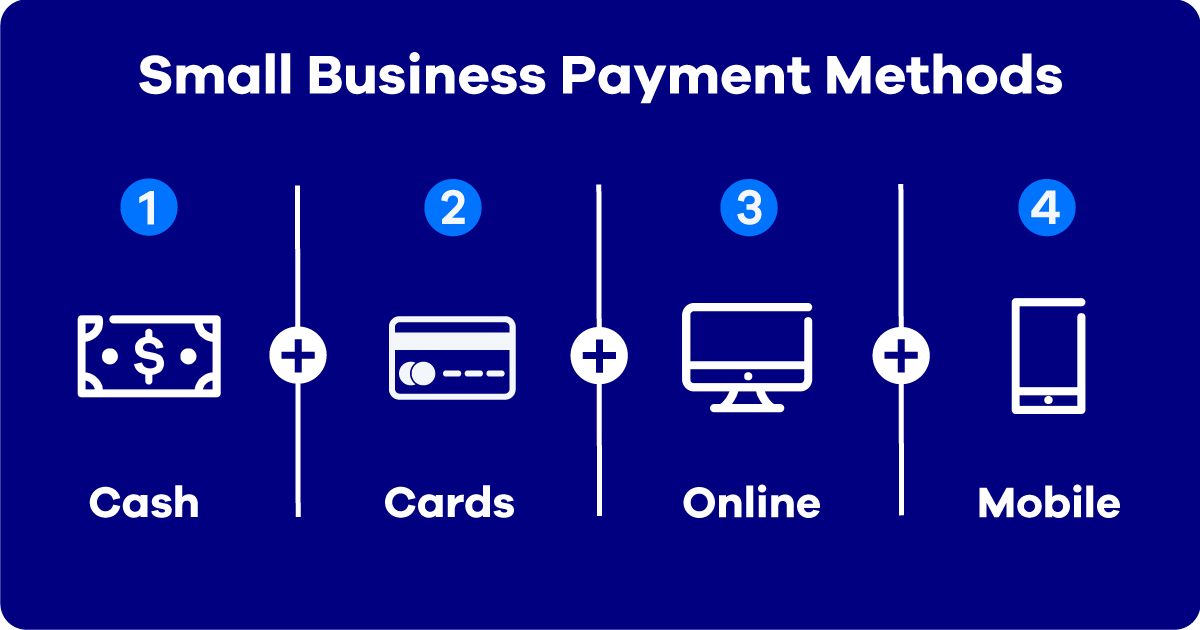

As a small business owner, one of the most critical decisions you’ll make revolves around how you accept payments. Choosing the right payment methods can significantly impact your customer satisfaction, cash flow, and overall business success. The digital landscape is constantly evolving, presenting a wide array of options beyond traditional cash and checks. Understanding the nuances of each method, including associated fees, security measures, and integration capabilities, is essential for making informed choices that align with your business needs and target audience. This guide will explore various payment options available to small business owners, empowering you to select the most suitable solutions for your specific circumstances.

Traditional Payment Methods

While digital payment methods are gaining popularity, traditional options still hold a significant place in the market. Understanding their pros and cons is crucial for a well-rounded payment strategy.

Cash

Cash remains a widely accepted form of payment, especially for smaller transactions. However, handling large amounts of cash can be risky and requires careful management.

Checks

Checks are becoming less common, but some customers still prefer them, particularly for larger purchases. Processing checks can be time-consuming and carries the risk of bounced checks.

Digital Payment Methods

The rise of digital technology has brought about a plethora of payment options, offering convenience and speed for both businesses and customers.

Credit and Debit Cards

Accepting credit and debit cards is almost a necessity in today’s market. Customers expect to be able to use their cards for purchases, both in-store and online. Consider the following when selecting a card processing solution:

- Processing Fees: Understand the fees associated with each transaction, including interchange fees, assessment fees, and markup fees.

- Security: Ensure the payment processor complies with PCI DSS standards to protect customer data.

- Integration: Choose a processor that integrates seamlessly with your existing point-of-sale (POS) system or e-commerce platform.

Mobile Payments

Mobile payment apps like Apple Pay, Google Pay, and Samsung Pay are gaining traction, offering a contactless and convenient way for customers to pay. Accepting these payments can attract tech-savvy customers and streamline the checkout process.

Online Payment Gateways

If you sell products or services online, you’ll need an online payment gateway to process transactions securely. Popular options include:

- PayPal: A widely recognized and trusted platform with a large user base.

- Stripe: A developer-friendly platform with robust API integration capabilities.

- Authorize.net: A long-standing gateway with a wide range of features and integrations.

Cryptocurrencies

While still relatively niche, accepting cryptocurrencies like Bitcoin can appeal to a specific customer segment. However, it’s important to understand the volatility and security risks associated with cryptocurrencies before accepting them as payment.

Choosing the Right Payment Methods

Selecting the optimal payment methods for your small business requires careful consideration of several factors, including your target audience, industry, transaction volume, and budget. Research different options, compare fees and features, and prioritize security and customer convenience. Regularly evaluate your payment processing solutions and adapt as needed to stay competitive in the evolving market.

Ultimately, the decision of which payment methods to accept is a personal one for your business. Think about your typical client and the methods they prefer. Consider offering a variety of options to accommodate the widest range of customers and increase sales. Don’t be afraid to adjust your strategy as your business grows and the payment landscape changes. By carefully weighing your options and prioritizing customer satisfaction, you can choose payment methods that contribute to the long-term success of your small business.

As a small business owner, one of the most critical decisions you’ll make revolves around how you accept payments. Choosing the right payment methods can significantly impact your customer satisfaction, cash flow, and overall business success. The digital landscape is constantly evolving, presenting a wide array of options beyond traditional cash and checks. Understanding the nuances of each method, including associated fees, security measures, and integration capabilities, is essential for making informed choices that align with your business needs and target audience. This guide will explore various payment options available to small business owners, empowering you to select the most suitable solutions for your specific circumstances.

While digital payment methods are gaining popularity, traditional options still hold a significant place in the market. Understanding their pros and cons is crucial for a well-rounded payment strategy.

Cash remains a widely accepted form of payment, especially for smaller transactions. However, handling large amounts of cash can be risky and requires careful management.

Checks are becoming less common, but some customers still prefer them, particularly for larger purchases. Processing checks can be time-consuming and carries the risk of bounced checks.

The rise of digital technology has brought about a plethora of payment options, offering convenience and speed for both businesses and customers.

Accepting credit and debit cards is almost a necessity in today’s market. Customers expect to be able to use their cards for purchases, both in-store and online. Consider the following when selecting a card processing solution:

- Processing Fees: Understand the fees associated with each transaction, including interchange fees, assessment fees, and markup fees.

- Security: Ensure the payment processor complies with PCI DSS standards to protect customer data.

- Integration: Choose a processor that integrates seamlessly with your existing point-of-sale (POS) system or e-commerce platform.

Mobile payment apps like Apple Pay, Google Pay, and Samsung Pay are gaining traction, offering a contactless and convenient way for customers to pay. Accepting these payments can attract tech-savvy customers and streamline the checkout process.

If you sell products or services online, you’ll need an online payment gateway to process transactions securely. Popular options include:

- PayPal: A widely recognized and trusted platform with a large user base.

- Stripe: A developer-friendly platform with robust API integration capabilities.

- Authorize.net: A long-standing gateway with a wide range of features and integrations.

While still relatively niche, accepting cryptocurrencies like Bitcoin can appeal to a specific customer segment. However, it’s important to understand the volatility and security risks associated with cryptocurrencies before accepting them as payment.

Selecting the optimal payment methods for your small business requires careful consideration of several factors, including your target audience, industry, transaction volume, and budget. Research different options, compare fees and features, and prioritize security and customer convenience. Regularly evaluate your payment processing solutions and adapt as needed to stay competitive in the evolving market.

Ultimately, the decision of which payment methods to accept is a personal one for your business. Think about your typical client and the methods they prefer. Consider offering a variety of options to accommodate the widest range of customers and increase sales. Don’t be afraid to adjust your strategy as your business grows and the payment landscape changes. By carefully weighing your options and prioritizing customer satisfaction, you can choose payment methods that contribute to the long-term success of your small business.

But are you truly maximizing your potential by sticking to only one or two methods? Shouldn’t you consider the diverse needs of your customer base? Are you prepared to lose potential sales by limiting payment options? Have you thoroughly researched the transaction fees associated with each method, and are you certain you’ve chosen the most cost-effective solutions? Could integrating a new payment gateway actually boost your online sales? And what about the security implications – are you fully compliant with all relevant regulations, and are you actively protecting your customers’ sensitive data? Is it time to re-evaluate your payment strategy and ensure it aligns with the ever-changing demands of the modern marketplace?