Investing in the stock market can seem daunting, especially for beginners. However, understanding the basics and focusing on specific investment strategies can make the process much more manageable. Large-cap stocks, representing companies with significant market capitalization, offer a potentially stable and relatively less volatile entry point into the world of investing. This guide will walk you through the fundamentals of investing in large-cap stocks, covering everything from understanding what they are to building a diversified portfolio.

What are Large-Cap Stocks? Understanding Market Capitalization

Large-cap stocks represent companies with a substantial market capitalization. Knowing what that means is key to understanding this type of investment.

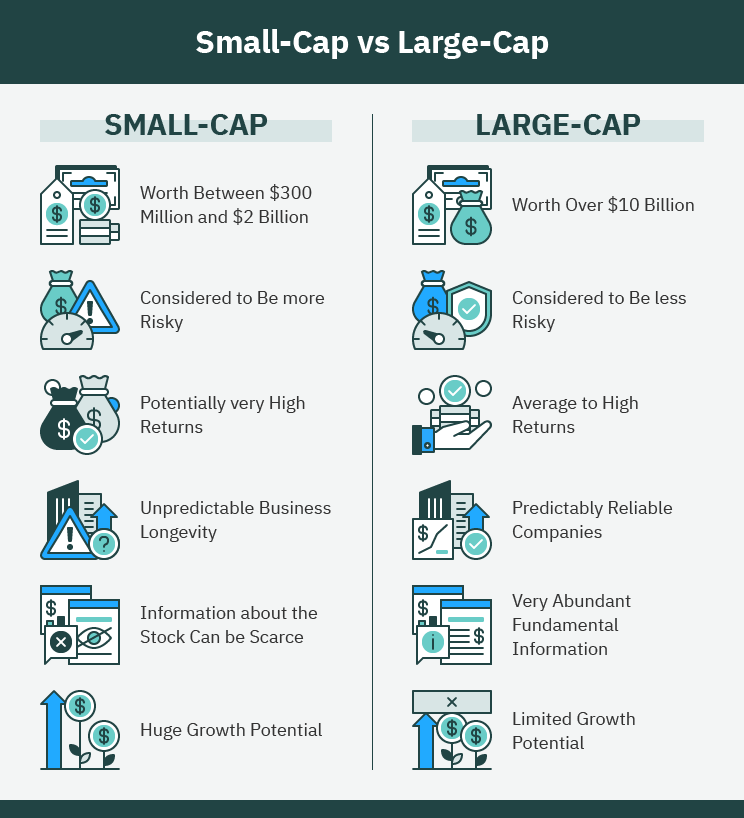

Market capitalization, often referred to as “market cap,” is the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the current stock price by the number of shares outstanding. Based on market capitalization, stocks are generally categorized as follows:

- Large-Cap: $10 billion or more

- Mid-Cap: $2 billion to $10 billion

- Small-Cap: $300 million to $2 billion

- Micro-Cap: Less than $300 million

Why Invest in Large-Cap Stocks? Weighing the Pros and Cons

Investing in large-cap stocks offers a variety of potential benefits, but it’s essential to understand the drawbacks as well. Here’s a balanced look:

Large-cap stocks are generally considered a safer investment option compared to mid- or small-cap stocks. Their stability comes from their established market position, strong financial performance, and wide recognition.

Pros of Investing in Large-Cap Stocks:

- Stability: Large-cap companies tend to be more financially stable and less prone to sudden market fluctuations.

- Dividends: Many large-cap companies pay regular dividends, providing a steady stream of income.

- Liquidity: Large-cap stocks are typically highly liquid, meaning they can be bought and sold easily without significantly impacting the price.

- Transparency: Large-cap companies are subject to stricter reporting requirements, providing investors with more information.

Cons of Investing in Large-Cap Stocks:

- Lower Growth Potential: Compared to smaller companies, large-cap stocks may have lower growth potential.

- Slower Pace: Gains might be slower than in other investment types, but this is sometimes offset by their stable growth.

- Vulnerability to Economic Downturns: While generally more stable, large-cap companies are still susceptible to broader economic downturns.

How to Choose the Right Large-Cap Stocks: A Step-by-Step Guide

Selecting the right large-cap stocks requires careful research and analysis. Consider these factors:

Choosing the right investments requires research. Remember, past performance is not indicative of future results.

| Factor | Description | Importance |

|---|---|---|

| Financial Health | Analyze the company’s balance sheet, income statement, and cash flow statement. Look for consistent revenue growth, healthy profit margins, and manageable debt levels. | High |

| Industry Position | Assess the company’s competitive position within its industry. Look for companies with a strong market share, brand recognition, and innovative products or services. | High |

| Management Team | Evaluate the quality and experience of the company’s management team. Look for leaders with a proven track record of success. | Medium |

| Valuation | Determine whether the stock is undervalued or overvalued. Consider metrics such as the price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield. | Medium |

Building a Diversified Large-Cap Portfolio

Diversification is crucial for managing risk in any investment portfolio. Here’s how to diversify your large-cap holdings:

Diversification is a risk-management strategy that involves spreading your investments across a variety of assets to reduce exposure to any single asset or risk.

- Invest Across Different Sectors: Don’t put all your eggs in one basket. Spread your investments across various sectors, such as technology, healthcare, consumer staples, and energy.

- Consider Index Funds and ETFs: Index funds and exchange-traded funds (ETFs) that track the S&P 500 or other large-cap indices provide instant diversification.

- Rebalance Regularly: Periodically review your portfolio and rebalance it to maintain your desired asset allocation.

FAQ: Investing in Large-Cap Stocks

Here are some frequently asked questions about investing in large-cap stocks:

- Are large-cap stocks a good investment for beginners? Yes, they are generally considered a good starting point due to their stability and lower volatility.

- What is the best way to buy large-cap stocks? You can buy them through a brokerage account, either online or with a financial advisor.

- How much money do I need to start investing in large-cap stocks? The amount depends on the price of the stocks you want to buy. You can start with a small amount and gradually increase your investment over time. Some brokers even allow you to buy fractional shares.

- Should I invest in individual large-cap stocks or an index fund? Both are valid options. Individual stocks offer the potential for higher returns, but also carry more risk. Index funds provide instant diversification and are generally less risky.

- How often should I check my large-cap stock investments? Monitor your investments regularly, but avoid making impulsive decisions based on short-term market fluctuations. A quarterly review is often sufficient.

Investing in large-cap stocks can be a solid foundation for a long-term investment strategy. Their relative stability and potential for dividend income make them an attractive option for risk-averse investors. Remember to conduct thorough research, diversify your portfolio, and consult with a financial advisor to determine the best investment approach for your individual needs and goals. While large-cap stocks are generally less volatile than smaller-cap stocks, they are still subject to market risk, and it is possible to lose money on your investments. With a well-planned strategy and a long-term perspective, investing in large-cap stocks can contribute to building a secure financial future.

I’ve been investing in large-cap stocks for over a decade now, and it’s become a cornerstone of my retirement strategy. Honestly, when I first started, the sheer volume of information was overwhelming. I remember spending hours poring over financial statements, trying to decipher all the jargon. Initially, I leaned heavily on recommendations from financial news outlets, which, in hindsight, wasn’t the smartest approach. I bought a few stocks based on hype, and let’s just say, my portfolio took a hit.

My Journey: Learning from Mistakes and Finding Success in Large-Cap Investments

It wasn’t until I started focusing on understanding the underlying businesses that things really turned around. Learning to read financial reports and understanding what they mean was a game changer for me.

I quickly learned that investing is a personal journey. What works for my friend, Sarah, might not work for me. I had to find my own comfort level with risk and develop a strategy that aligned with my financial goals.

My Personal “Must-Haves” Before Investing in a Large-Cap Stock:

I’ve developed a checklist of sorts that I run through before I even consider investing in a particular large-cap stock. These are the things I personally look for, based on my experience.

- Consistent Dividend Payouts: I love the security of knowing I’ll receive regular dividend payments. It’s like getting paid to own a piece of a successful company. I look for companies with a history of increasing their dividends over time. I was particularly impressed with Johnson & Johnson before all the lawsuits; their consistent dividend growth was a major draw for me.

- Strong Brand Recognition: A recognizable brand often translates to pricing power and customer loyalty. Companies like Coca-Cola or Apple have a built-in advantage due to their strong brand recognition. I invested in Apple years ago, and it’s been one of my best performers. Seeing that logo everywhere just reinforced my confidence in their long-term prospects.

- A Clear Understanding of Their Business Model: I need to understand how the company makes money. If I can’t explain it to my neighbor, then I probably shouldn’t be investing in it. I stayed away from investing in Tesla for a long time because I didn’t understand how they could scale their production to meet demand. I still have some reservations even though they are now a major player.

- Sustainable Competitive Advantage (Moat): Does the company have something that protects it from competitors? This could be a strong brand, patented technology, or a unique distribution network. For instance, Microsoft’s dominance with its software is a good example of a moat.

My Biggest Win and My Biggest Loss (So Far):

Investing is a learning process. You win some, you lose some. It’s how you learn from those experiences that really matters. Here are two examples.

Here are two examples of how I learned and grew.

| Investment | Outcome | Lesson Learned |

|---|---|---|

| Amazon (AMZN) | Significant Gains | Early on, I recognized the potential of e-commerce and the power of Amazon’s logistics network. I bought and held, ignoring the short-term market fluctuations. It paid off handsomely. Holding for the long term, even through volatility, can be extremely rewarding, especially with companies that are consistently innovating. |

| General Electric (GE) | Substantial Losses | I held onto GE for too long, hoping for a turnaround that never came. I was blinded by the company’s past reputation and failed to recognize the fundamental problems with their business model. I learned the importance of cutting my losses and moving on. Don’t let nostalgia cloud your investment judgment! |

My Approach to Diversification: Beyond Just Sectors

Diversification isn’t just about spreading your investments across different sectors. I’ve found that diversifying within the large-cap space itself can be just as important. I also diversify into different countries.

I’ve taken diversification to a new level and found success.

- Geographic Diversification: Don’t just invest in US-based companies. Consider investing in large-cap companies in Europe or Asia. This can help reduce your exposure to the US economy. I’ve found that investing in companies like Nestle (Switzerland) or Toyota (Japan) provides some diversification benefits.

- Investment Style Diversification: Consider investing in both growth and value stocks. Growth stocks are companies that are expected to grow at a faster rate than the market average, while value stocks are companies that are trading at a discount to their intrinsic value. I balance my portfolio with both types of stocks.

- Index Funds and ETFs: As mentioned before, these are excellent for instant diversification. I have a significant portion of my portfolio allocated to S&P 500 index funds. They provide broad market exposure and are relatively low-cost.

Honestly, investing in large-cap stocks has been a journey of trial and error for me. I’ve made mistakes, learned from them, and ultimately developed a strategy that works for me. It’s not about getting rich quick; it’s about building a solid foundation for long-term financial security. Remember to do your own research, consult with a financial advisor if needed, and never invest more than you can afford to lose. While large-cap stocks are generally considered less risky than other types of investments, they are still subject to market risk, and it’s always possible to lose money. I am happy to say that I sleep well at night knowing I have a plan in place and understand the potential ups and downs of my investments. Investing in myself and educating myself was the best decision I ever made. So, take your time and be patient. Good luck, and happy investing!