Navigating the complex world of Forex trading can be daunting, especially for beginners. The allure of profit is strong, but the risk of loss is equally significant. Forex signal providers offer a potential shortcut, promising to deliver profitable trading ideas directly to your inbox or trading platform. But with so many options available, how do you choose the best forex signal provider for your individual needs and risk tolerance? This article will explore the key aspects to consider, helping you make an informed decision.

Understanding Forex Signals and Their Purpose

Forex signals are essentially trading recommendations or suggestions provided by experienced traders or automated systems. They aim to simplify the trading process by identifying potential entry and exit points for currency pairs.

Here’s a quick overview of what a typical Forex signal might include:

- Currency Pair: The specific currency pair the signal refers to (e.g., EUR/USD, GBP/JPY).

- Entry Price: The recommended price at which to enter the trade.

- Stop Loss: The price level at which to automatically close the trade to limit potential losses.

- Take Profit: The price level at which to automatically close the trade to secure profits.

- Direction: Whether to buy (go long) or sell (go short) the currency pair.

Key Factors to Consider When Choosing a Provider

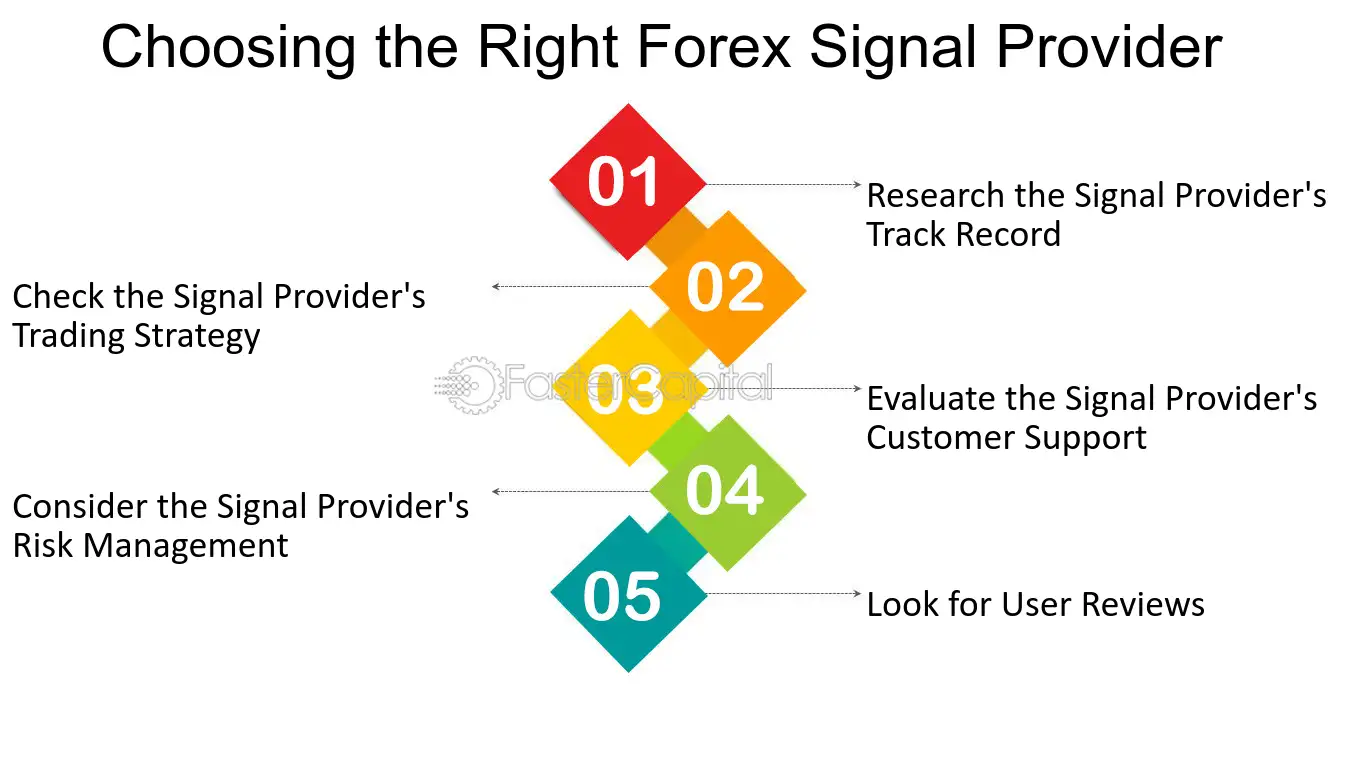

Selecting the right forex signal provider is crucial for maximizing your chances of success. Consider these important factors:

Provider Reputation and Track Record

A provider’s reputation and track record are paramount. Look for established providers with a verifiable history of generating profitable signals.

Here’s how to assess a provider’s reputation:

- Read Reviews: Research online reviews and testimonials from other traders.

- Check Performance: Scrutinize their historical performance data, paying attention to win rates, profit factors, and drawdown.

- Beware of Guarantees: Be skeptical of providers promising guaranteed profits, as Forex trading inherently involves risk.

Cost and Subscription Models

Forex signal providers offer various subscription models, ranging from free services to premium packages. Evaluate the cost-effectiveness of each option.

Consider the following aspects of cost:

| Subscription Type | Cost | Features | Suitability |

|---|---|---|---|

| Free | Free | Basic signals, limited access | Beginners, testing purposes |

| Paid (Monthly) | Varies | More frequent signals, detailed analysis | Intermediate traders |

| Paid (Premium) | Higher price | VIP support, advanced strategies, personalized guidance | Experienced traders |

Risk Management Strategies

A reputable provider will emphasize risk management and provide clear stop-loss recommendations. This helps protect your capital and prevent significant losses.

Look for providers that:

- Provide clear stop-loss levels for each signal.

- Encourage the use of appropriate position sizing.

- Offer guidance on managing risk tolerance.

FAQ: Choosing a Forex Signal Provider

Here are some frequently asked questions about choosing a forex signal provider:

Are free Forex signals reliable?

Free Forex signals can be unreliable. While some may be legitimate, many are of poor quality or are designed to promote specific brokers. Exercise caution when using free signals.

How do I test a Forex signal provider?

Before committing to a paid subscription, consider using a demo account to test the provider’s signals. This allows you to evaluate their accuracy and consistency without risking real money.

What is “pip” and why is it important when evaluating signal performance?

A “pip” (percentage in point) is the smallest unit of price movement in Forex. Evaluating signal performance in terms of pips won or lost provides a standardized measure of profitability.

Can Forex signals guarantee profits?

No, Forex signals cannot guarantee profits. Forex trading involves inherent risk, and even the best signals can result in losses. Use signals as a tool to aid your trading decisions, not as a guaranteed path to wealth.

Choosing the best forex signal provider requires careful research and consideration of your individual trading goals and risk tolerance. Remember to prioritize reputation, track record, and risk management strategies. Don’t be swayed by unrealistic promises of guaranteed profits. Always test signals on a demo account before risking real money. By taking a diligent approach, you can increase your chances of finding a provider that complements your trading style and helps you achieve your financial objectives. The world of Forex trading is dynamic, and continuous learning is essential for long-term success. Good luck on your trading journey!

My Personal Journey with Forex Signal Providers

After years of navigating the Forex market, I decided to explore the world of signal providers. I was initially skeptical, having heard both success stories and tales of woe. I approached the process with a healthy dose of caution and a commitment to thorough testing. My goal was simple: to find a reliable source of trading ideas that could supplement my own analysis and potentially improve my overall profitability.

My First Experiment: “QuickTrade Pro”

My first foray was with a provider called “QuickTrade Pro.” They offered a free trial, which was appealing. The signals arrived promptly, but I quickly noticed inconsistencies. Some were profitable, others were not, and the risk management was virtually nonexistent. I remember one particularly disastrous EUR/USD signal where the stop-loss was so wide that a small dip triggered a significant loss. I realized that relying solely on their signals without independent analysis was a recipe for disaster. I quickly learned the hard way that free is not always better and terminated my trial.

Finding a Gem: “PrecisionFX Signals”

Undeterred, I decided to invest in a premium provider with a solid reputation: “PrecisionFX Signals.” What caught my eye was their transparent track record and emphasis on risk management. They provided detailed reports on past performance, including win rates, profit factors, and maximum drawdown. Their signals also came with clear stop-loss and take-profit levels. I was impressed by their commitment to educating subscribers about responsible trading practices. I was initially hesitant to sign up for their $199 per month subscription but decided to give it a try.

Here’s a breakdown of my experience with PrecisionFX Signals:

- Signal Quality: The signals were generally well-researched and aligned with my own technical analysis.

- Risk Management: Their stop-loss recommendations were consistently prudent, protecting my capital from excessive losses.

- Customer Support: Their customer support was responsive and helpful, answering my questions promptly and thoroughly.

- Performance: Over a three-month period, I saw a modest improvement in my trading performance. While not a life-changing windfall, it was a consistent gain that made the subscription worthwhile. I especially liked the signals for GBP/JPY. I felt I understood how they were generated and why they were so good.

The Importance of Independent Analysis

Even with PrecisionFX Signals, I never blindly followed their recommendations. I always conducted my own independent analysis to validate their signals and ensure they aligned with my own market outlook. This involved reviewing the charts, analyzing economic data, and considering market sentiment. I found that combining their signals with my own research led to better trading decisions and more consistent profits.

My Conclusion and Recommendation

My journey with Forex signal providers has taught me valuable lessons. It’s not about finding a magic bullet that guarantees riches. It’s about finding a reliable source of trading ideas that can complement your own analysis and improve your overall trading strategy. I found that PrecisionFX Signals worked for me, but it may not be the best choice for everyone. My advice to anyone considering using Forex signals is to do your research, test providers thoroughly, and never rely solely on their recommendations. Always remember that Forex trading involves risk, and responsible risk management is essential for long-term success. I found that testing several providers on a demo account first was essential.