The dream of homeownership often comes with a hefty mortgage. But did you know that Uncle Sam might offer a little help, in the form of tax deductions? Itemizing deductions, including mortgage interest, can significantly reduce your taxable income, potentially leading to substantial savings. Let’s delve into the world of mortgage interest itemization and explore how it can benefit you and your financial well-being. Understanding the rules and eligibility is key to maximizing these tax advantages.

Understanding Mortgage Interest and Itemization

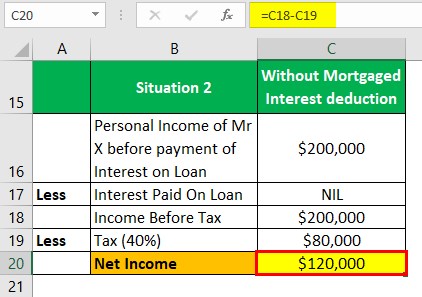

Mortgage interest is the fee you pay to a lender for borrowing money to buy, build, or improve your home. Itemization is a way of calculating your taxes where you list out individual deductions to reduce your taxable income, instead of taking the standard deduction.

Who Can Itemize Mortgage Interest?

Generally, homeowners who meet certain criteria can itemize mortgage interest. Here’s a quick overview:

- You must own your home.

- You must be legally liable for the mortgage debt.

- Your mortgage must be secured by your home.

- The interest must be actually paid during the tax year.

Factors Affecting Your Deduction

Several factors influence the amount of mortgage interest you can deduct. Let’s break down some key elements:

Home Equity Debt: The rules for deducting interest on home equity debt changed after 2017. It’s important to understand the current limitations.

Loan Limits: How Much Can You Deduct?

There are limits to the amount of mortgage debt on which you can deduct interest. These limits have changed over time, so it’s crucial to know the rules for the year in question. The information below is for informational purposes only and does not constitute financial advice. Always consult a tax professional.

| Tax Year | Acquisition Debt Limit (Married Filing Jointly) | Acquisition Debt Limit (Single) |

|---|---|---|

| Before Dec. 16, 2017 | $1,000,000 | $500,000 |

| After Dec; 15, 2017 | $750,000 | $375,000 |

How to Itemize Mortgage Interest

Itemizing requires filling out Schedule A (Form 1040). Here’s a step-by-step guide:

- Gather your documents: You’ll need Form 1098 from your mortgage lender, showing the amount of interest you paid.

- Complete Schedule A: Fill out the necessary sections, including the amount of mortgage interest paid.

- Determine if itemizing is beneficial: Compare your total itemized deductions to the standard deduction for your filing status. Choose the higher amount.

FAQ: Frequently Asked Questions

Let’s address some common questions about itemizing mortgage interest.

- Can I deduct points I paid when getting my mortgage? Yes, points are generally deductible, but may need to be amortized over the life of the loan.

- What if I refinance my mortgage? You can usually deduct the interest on the new mortgage, subject to the same limitations.

- How do I know if itemizing is right for me? Compare your itemized deductions to the standard deduction. If your itemized deductions are higher, it’s generally beneficial to itemize.

Consult a tax professional for personalized advice as tax laws can be complex and change frequently.

The decision to itemize mortgage interest hinges on carefully evaluating your individual financial landscape. While navigating the tax codes may seem daunting, the potential tax savings can make it a worthwhile endeavor. Remember to compare your itemized deductions with the standard deduction to determine the most advantageous approach. Keeping accurate records and seeking professional guidance will ensure you’re making informed decisions about your tax strategy. By understanding the nuances of mortgage interest itemization, you can potentially unlock significant financial benefits. Ultimately, managing your finances wisely can lead to a more secure and prosperous future.

Beyond Interest: Other Deductible Home-Related Expenses

Mortgage interest isn’t the only home-related expense you might be able to deduct. Explore these additional possibilities:

Real Estate Taxes: Property taxes are often deductible, but there are limitations. Understanding these limits is crucial for maximizing your deduction.

The SALT Deduction: A Key Consideration

The Tax Cuts and Jobs Act of 2017 limited the deduction for state and local taxes (SALT), including property taxes. Here’s what you need to know:

Deduction Cap: The SALT deduction is capped at $10,000 per household. This limit applies to the combined total of state and local property taxes, as well as state and local income (or sales) taxes.

Strategic Planning: Consider strategies to optimize your SALT deduction, such as prepaying property taxes (if permitted) or shifting income to lower-tax states.

When Itemizing Doesn’t Make Sense

While itemizing can be beneficial, it’s not always the right choice. Let’s explore situations where taking the standard deduction might be more advantageous:

Low Itemized Deductions: If your total itemized deductions are less than the standard deduction for your filing status, it’s generally best to take the standard deduction.

Understanding the Standard Deduction

The standard deduction is a fixed amount that reduces your taxable income. The amount varies depending on your filing status (e.g., single, married filing jointly, head of household) and is adjusted annually for inflation. Here’s a quick look at an example from 2024:

| Filing Status | Standard Deduction (2024 Example) |

|---|---|

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Head of Household | $21,900 |

These numbers are for example only. Always check the current year’s IRS guidelines for the most up-to-date figures.

Navigating Tax Law Changes

Tax laws are constantly evolving, so it’s crucial to stay informed about any changes that may affect your ability to itemize mortgage interest or other deductions.

- Stay Updated: Regularly check the IRS website for updates and guidance.

- Seek Professional Advice: Consult with a qualified tax professional who can provide personalized advice based on your specific circumstances.

Understanding whether you can itemize mortgage interest and other home-related expenses is a critical component of effective tax planning. By carefully evaluating your financial situation, considering the applicable rules and limitations, and seeking professional guidance when needed, you can make informed decisions that maximize your tax benefits. Remember that tax laws can be complex, and what works for one person may not work for another. Staying informed and proactive is key to achieving your financial goals and securing a brighter future. Prioritize accurate record-keeping and consult with a tax advisor to optimize your tax strategy for the year. Take control of your finances and leverage the available tax benefits to enhance your overall financial well-being. Ultimately, informed financial decisions contribute to a more secure and prosperous life.