The question of whether car loans constitute a debt to banks is a common one, often sparking confusion about financial obligations. Understanding the nature of car loans is crucial for responsible financial planning. Essentially, a car loan represents a contractual agreement where a bank or financial institution provides funds to an individual for the purchase of a vehicle. This agreement legally obligates the borrower to repay the borrowed amount, along with agreed-upon interest, over a specified period, making it a form of debt.

Understanding Car Loans as a Form of Debt

When you take out a car loan, you are essentially borrowing money from a lender (typically a bank, credit union, or finance company) to purchase a vehicle. This creates a debt obligation. The lender holds a lien on the car until the loan is fully repaid. This means they have a legal claim to the vehicle if you fail to make your payments. The loan agreement outlines the terms of the debt, including the interest rate, repayment schedule, and any associated fees.

Key Components of a Car Loan Debt

- Principal: The original amount of money borrowed.

- Interest: The cost of borrowing the money, expressed as a percentage.

- Fees: Additional charges associated with the loan, such as origination fees or late payment fees.

- Repayment Schedule: The agreed-upon schedule for making payments, typically monthly.

The Impact of Car Loan Debt on Your Finances

Car loan debt can significantly impact your overall financial health. It affects your credit score, which is a crucial factor in obtaining other loans or credit in the future. High car loan payments can also strain your budget, limiting your ability to save or invest. Therefore, it’s essential to carefully consider your ability to repay a car loan before taking one out.

Managing car loan debt effectively involves making timely payments, avoiding late fees, and potentially exploring options like refinancing if interest rates drop. It’s also wise to avoid taking out a loan for more than you can comfortably afford;

FAQ: Car Loans and Debt

Are car loans considered good debt or bad debt?

Whether a car loan is “good” or “bad” debt is subjective and depends on individual circumstances. Generally, debt that appreciates in value or generates income (like a mortgage or student loan) is considered “good” debt. Car loans, as the vehicle depreciates, are often considered “bad” debt. However, a car can be essential for work and daily life, making the loan a necessary expense.

What happens if I can’t repay my car loan?

If you fail to make your car loan payments, the lender can repossess the vehicle. This will negatively impact your credit score and could lead to further legal action.

Can I refinance my car loan?

Yes, refinancing your car loan involves taking out a new loan with different terms (e.g., lower interest rate, longer repayment period) to pay off your existing loan. This can potentially save you money over the life of the loan.

How does a car loan affect my credit score?

Making timely car loan payments can positively impact your credit score. Conversely, late payments or defaulting on the loan will negatively affect your credit score.

Alternatives to Car Loans: Exploring Your Options

While car loans are a common way to finance a vehicle purchase, they aren’t the only option. Exploring alternatives can potentially save you money and reduce your overall debt burden. Consider these possibilities:

- Paying with Cash: If possible, saving up and paying for a car with cash is the most financially sound approach. This eliminates the need for borrowing and avoids interest charges altogether.

- Used Car Market: Opting for a reliable used car instead of a brand-new one can significantly reduce the purchase price and the amount you need to borrow.

- Public Transportation/Cycling: Depending on your location and lifestyle, utilizing public transportation or cycling could be viable alternatives, eliminating the need for a car altogether.

- Leasing: Leasing a car involves making monthly payments for the use of the vehicle, but you don’t own it at the end of the lease term. While it can offer lower monthly payments, it doesn’t build equity and may have mileage restrictions.

Comparative Table: Car Loan vs. Alternatives

| Option | Pros | Cons |

|---|---|---|

| Car Loan | Allows immediate purchase, builds credit (with responsible repayment). | Incurs interest charges, creates debt, vehicle depreciates. |

| Cash Purchase | No debt, no interest charges, full ownership. | Requires significant upfront savings, may delay purchase. |

| Used Car | Lower purchase price, reduced loan amount (if needed). | Potential for higher maintenance costs, may require more research. |

| Leasing | Lower monthly payments, access to newer models. | No ownership, mileage restrictions, potential for excess wear and tear charges. |

Strategies for Managing Existing Car Loan Debt

If you already have a car loan, there are strategies you can employ to manage it effectively and potentially reduce your overall costs:

- Refinancing: As mentioned earlier, refinancing can secure a lower interest rate or a more favorable repayment term.

- Accelerated Payments: Making extra payments whenever possible can shorten the loan term and reduce the total interest paid.

- Budgeting and Prioritization: Carefully budgeting your expenses and prioritizing car loan payments can help you avoid late fees and maintain a good credit score.

- Debt Consolidation: If you have multiple debts, consolidating them into a single loan with a lower interest rate could simplify your finances and save you money.

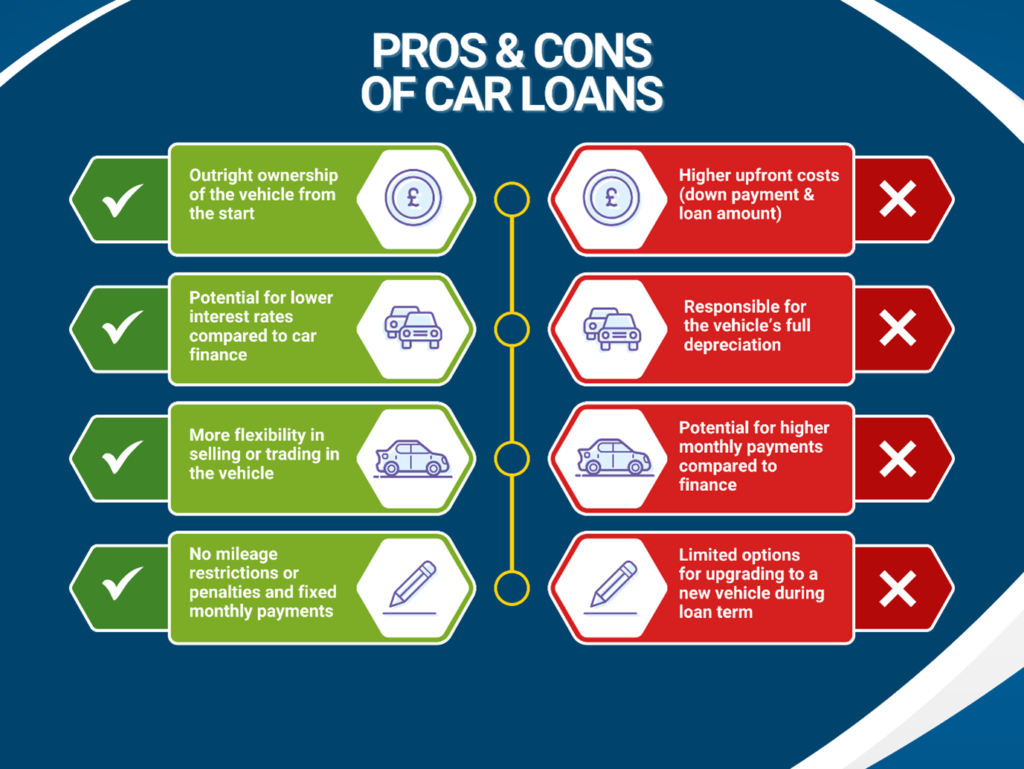

Ultimately, the decision of whether or not to take out a car loan is a personal one that should be based on your individual financial circumstances and needs. By carefully considering the pros and cons, exploring alternatives, and managing your debt responsibly, you can make informed decisions that align with your financial goals. Remember, understanding the implications of a car loan is crucial for maintaining financial stability. As you navigate the complexities of vehicle financing, remember that a well-informed decision is the best defense against unnecessary debt.

Ultimately, the decision of whether or not to take out a car loan is a personal one that should be based on your individual financial circumstances and needs. By carefully considering the pros and cons, exploring alternatives, and managing your debt responsibly, you can make informed decisions that align with your financial goals. Remember, understanding the implications of a car loan is crucial for maintaining financial stability. As you navigate the complexities of vehicle financing, remember that a well-informed decision is the best defense against unnecessary debt.

Navigating the Fine Print: Understanding Loan Agreements

Before signing on the dotted line, it’s paramount to thoroughly understand the car loan agreement. This document outlines all the terms and conditions of the loan, including the interest rate, repayment schedule, penalties for late payments, and the lender’s rights in case of default. Don’t hesitate to ask questions and seek clarification on any aspects you don’t fully comprehend. A well-understood agreement is your shield against unexpected financial burdens.

Key Elements to Scrutinize in a Car Loan Agreement:

- Annual Percentage Rate (APR): This is the true cost of borrowing, including interest and fees, expressed as a yearly rate. Compare APRs across different lenders to find the best deal.

- Loan Term: The length of time you have to repay the loan. Longer terms mean lower monthly payments but higher overall interest costs.

- Prepayment Penalties: Some lenders charge a penalty if you pay off the loan early. Avoid loans with prepayment penalties if possible.

- Late Payment Fees: Understand the amount and frequency of late payment fees.

- Repossession Clause: Know the lender’s rights to repossess the vehicle if you default on the loan.

- Gap Insurance: Consider gap insurance, which covers the difference between the loan balance and the vehicle’s value if it’s totaled in an accident.

The Psychological Impact of Debt

Beyond the financial implications, debt can also have a significant psychological impact. The constant pressure of making payments can lead to stress, anxiety, and even depression. It’s crucial to be mindful of the emotional toll that debt can take and to develop healthy coping mechanisms. Open communication with loved ones, seeking financial counseling, and practicing stress-reducing activities can help mitigate the psychological burden of car loan debt.

Future-Proofing Your Finances: Planning for the Unexpected

Life is unpredictable, and unexpected events can disrupt your ability to make car loan payments. It’s essential to have a financial safety net in place to protect yourself from unforeseen circumstances. Consider building an emergency fund, obtaining disability insurance, and exploring options for payment deferral or forbearance in case of job loss or medical emergencies. Proactive planning can provide peace of mind and prevent financial hardship.